Do you want to know the permits you need to open a restaurant in Mexico? Do you want to know how to open a restaurant in Mexico?

Opening a restaurant in Mexico is a great decision accompanied by procedures, operating permits, and more.

Despite that, it's not something you should be intimidated by — many entrepreneurs shiver at the question of how to open a restaurant. However, starting a business is still one of the best ways to gain precious financial freedom, and it's within hand reach.

That is why I have created a complete list of all the permits that you must obtain to open a restaurant or food truck in Mexico.

This list will be useful regardless of where you are in Mexico — later in the story why.

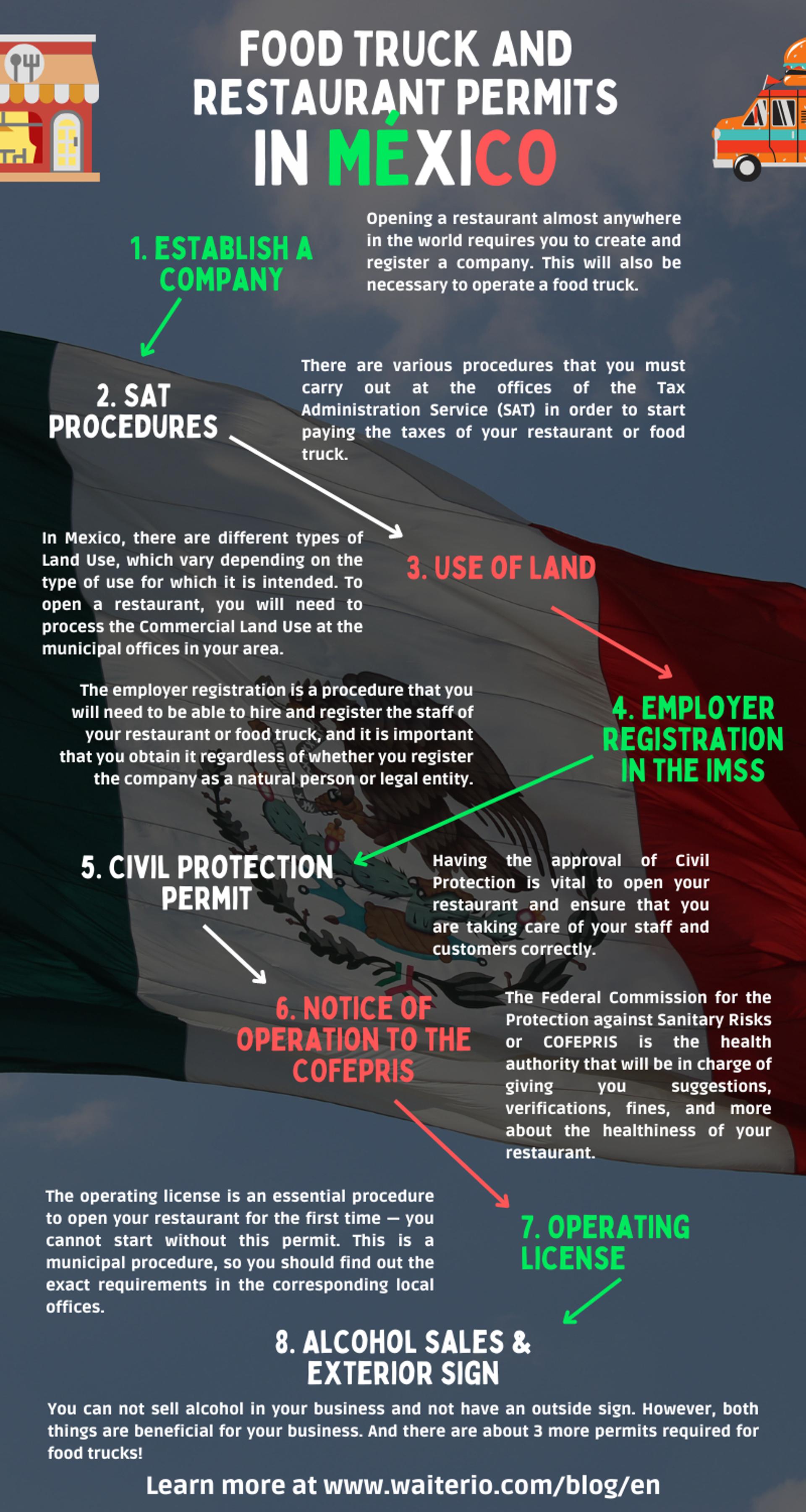

These are the permits, procedures, and licenses that you will need for a restaurant and a food truck:

- Register and establish a company.

- SAT procedures.

- Uso de Suelo (Use of Soil).

- Employer registration in the IMSS (Mexican Institute of Social Security).

- Permit or Visto Bueno of Civil Protection.

- Notice of operation to COFEPRIS (Federal Commission for the Protection Against Sanitary Risks).

- Operating license.

- State license for the sale of alcoholic beverages.

- Permission for exterior advertisement.

- Permission to trade in public spaces (food truck)

- Proof of the Ministry of Health (food truck)

- Permit or Visto Bueno of Civil Protection (food truck)

With these permits and licenses, you will have everything you need to be able to start operating your restaurant.

It should be noted that you must start building your restaurant or renting the facilities before starting to obtain them.

Let's get started!

What Permits Are Necessary When Opening a Restaurant in Mexico?

Opening a restaurant in Mexico requires at least 8 permits and licenses (except for the permit for selling alcoholic beverages, which is optional, but very beneficial). To obtain some of these permits you will require the help of a legal advisor or representative.

Constitution of the Company

Opening a restaurant almost anywhere in the world requires you to create and register a business. You can also do this to open a food truck. This is one of the most important requirements that you must attend to at the beginning of this bureaucratic journey.

To register your company in Mexico you just have to:

- Obtain the approval of the name of your company from the Ministry of Economy.

- And prepare a charter for your company.

I will talk more about these two requirements below.

Request the Company Name at the Ministry of Economy

The Ministry of Economy is the entity basically in charge of registering your company.

For that, you must go to the delegations and sub-delegations of the Ministry of Economy.

You can also use the e.Firma (e.Signature) — which I will tell you about later — to complete the procedure online. This procedure is completely free and it will not take more than a week to get a response. All you need is to provide information about the company you want to register.

Incorporation of Your Company

This step is optional since you can register your company as a natural person or legal entity.

If you decide to register your company as a legal entity, then you will necessarily need a charter. To draft the articles of incorporation of your company, you must have legal advice. This is very important to write a charter that complies with general regulations. It should contain information about the company, the members of the society, and more. It’ll be done once signed before a notary public and at the Public Property Registry. The costs for this procedure can vary between $5,000 and $10,000 mxn depending on where you are and the notary public.

SAT Procedures

There are various procedures that you must complete at the Tax Administration Service (SAT in Spanish) offices to start paying taxes for your restaurant or food truck.

- Federal taxpayer registration.

- e.Firma. and Processing of digital seal certificate.

These procedures are quite simple, although they do have many requirements.

Federal Taxpayer Registration

You will be able to process your company's RFC at the SAT offices of the town where you registered your company.

You can also pre-register your company online from the SAT portal.

You must fill in the forms with all the information on the constitution of your company, your partners, the type of business you plan to establish and its economic activity, and more.

Then, you will receive a receipt of acknowledgment of pre-registration to the Federal Taxpayers Registry.

You will have to print it, schedule an appointment at the SAT, and come on the day you choose with the following documents:

- Official document of incorporation (certified copy).

- Acknowledgment of pre-registration in the RFC, in the case of having initiated the application through the SAT Portal.

- Proof of address.

- Power of attorney in case of legal representation, proving the personality of the legal representative (certified copy), or power of attorney signed before two witnesses and the signatures ratified before the tax authorities or before a public notary (original). If it was granted abroad, it must be duly apostilled or legalized and have been formalized before a Mexican public notary and, where appropriate, have a translation into Spanish by an authorized expert.

- Current and original official identification of the legal representative.

- In the case of legal entities other than those with non-profit purposes, they must present the valid Federal Taxpayers Registry code of each of the partners, shareholders, or associates mentioned in the articles of incorporation (simple copy).

- A written statement that contains the valid RFC keys of the partners, shareholders or associates, if they are not found within the (original) articles of incorporation.

Because it has similar requirements to those of the e.Firma process, you can complete both procedures on the same day and save a lot of time.

Process the e.Firma of Your Company

To process the e.Firma of your company you must present:

- An email you use.

- A flash drive (USB) with a .req file previously generated using the Certifica program.

- The official FE form "Solicitud de Certificado de e.Firma". You can download it on this page of the SAT portal. You must present it in duplicate and sign with a blue ink pen.

- A certified copy of the notarized constitutive document of the company.

- Valid official identification of the legal representative of the company.

- A certified copy of the general power of attorney for acts of domain or administration proves the legal representative’s identity. If it has been carried out abroad, it must be duly legalized or apostilled and formalized before a Mexican public notary.

- The RFC code of each of the partners, shareholders, or associates mentioned in the articles of incorporation. If there are more than five partners, you must bring a removable memory with an Excel file (.XLSX) with certain specifications that you will find in this PDF file.

- A written statement that contains the valid RFC keys of the partners, shareholders, or associates, if they are not found within the (original) articles of incorporation.

You must have legal advice to validate these requirements in advance.

This will save you a lot of time!

To do it as a natural person (only if you’re Mexican, resident, or citizen), you will only need:

- CURP or birth certificate of the legal representative.

- Valid official identification (it can be your passport, driver's license, professional card, or INAPAM credential for older adults)

- Proof of tax address.

- Company charter.

After completing this process (which is much faster than it seems), you will receive the acknowledgment of registration with the Federal Taxpayer Registry (RFC) and a guide to your company’s tax obligations.

Then, you can process the Digital Seal Certificate to issue invoices.

This process begins by generating a file (.sdg) using the program SAT Certifica. The steps are quite simple and you will only require your e.Firma.

Uso de Suelo Comercial

One of the first permits you will need is the Uso de Suelo Comercial or Commercial Land Use.

In Mexico, there are different types of Land Use, which vary depending on the type of use to which it is intended.

To open a restaurant, you will need to process the Commercial Land Use in the municipal offices of the city where you want to open the restaurant.

Some of the requirements are:

- Articles of incorporation.

- Valid official identification with photograph.

- Proof of address.

- Location sketch.

- Property deeds.

- Topographic map.

- Valid property ticket.

- An application letter.

- UTM coordinate plane.

- And more depending on the municipality in which you are.

The costs of this procedure vary between $ 1,000 and $ 10,000 mxn. This is not necessary to open a food truck.

Employer Registration at the IMSS

Employer registration is a procedure that you will need to be able to hire and register the staff of your restaurant or food truck, and you must obtain it regardless of whether you register the company as an individual or legal entity.

These are the requirements:

- A copy of the Federal Taxpayers Registry (RFC) of the fiscal domicile and/or Notice of Establishment Opening.

- Original and copy of proof of the address of the work center.

- An original Sketch of the location of the workplace address.

- Valid official identification of the employer. Original and copy.

- Unique Population Registry Code (CURP). Copy.

- In the case of having a legal representative, a Power of Attorney for acts of domain, administration, or special power where it is specified that they can carry out all kinds of procedures and sign documents before the IMSS. Original and copy.

- Current official identification of the legal representative. Original and copy.

- Federal Taxpayers Registry (RFC) of the legal representative. Copy.

- Unique Population Registry Code (CURP) of the legal representative. Copy.

- Proof of tax address. Original and copy.

As you can see, this procedure can be carried out by the employer in person or by the company’s legal representative.

It is a free procedure and it does not take much time.

Permit or Civil Protection Approval

The Civil Protection Approval (visto bueno de Protección Civil) is something that you must request from the local Civil Protection jurisdiction in your restaurant’s area.

The requirements to get the permit may vary depending on where you are. However, as general rules you must:

- Comply with the rules dictated in NOM-001-STPS, NOM-002-STPS, and NOM-017-STPS. All these rules talk about the security measures of your restaurant.

- Have electrical installations in good condition.

- Have gas installations in good condition and correctly marked.

- You should have an internal civil protection program with an action plan in case of emergencies such as fires, earthquakes, and more.

- Your employees must have training certificates issued by your local Civil Protection entity.

- And more depending on the regulations of your locality.

Having the go-ahead from Civil Protection is vital to opening your restaurant and making sure you are taking care of your staff and customers correctly.

Operation notice to COFEPRIS

The Federal Commission for the Protection Against Sanitary Risks or COFEPRIS is the sanitary authority that will be in charge of giving you suggestions, verifications, fines, and more about the healthiness of your restaurant.

You should implement good health guidelines throughout your restaurant. This guide can be very useful to achieve this.

Once you open your restaurant (or even when everything is ready but before opening) you can give a Notice of Operation to COFEPRIS. You must provide all the information in the format.

After the notice, you can wait for regulatory visits at your restaurant.

Operating License

The Operating License is an essential procedure to open your restaurant for the first time — you cannot start without this permission.

This is a municipal procedure, so you should find out the exact requirements in the corresponding local offices.

Some common requirements are:

- Articles of Incorporation.

- Official identification (IFE, INE, valid passport).

- Federal Taxpayers Registry (RFC).

- Proof of address.

- Location sketch.

- Proof of payment.

- Power of attorney (with official identification of the attorney-in-fact)

- Land use license.

- Current municipal civil protection feasibility opinion.

- Sanitary license for economic units that sell food.

The cost of this procedure also varies a lot depending on where you are.

License for the Sale of Alcohol

If you want to offer alcoholic beverages in your restaurant, you will need a license for the sale of alcoholic beverages. Currently, these licenses are not granted to food trucks.

This type of license is obtained in your local municipality — the requirements and costs vary greatly depending on this.

It should be noted that this is one of the most important and most expensive permits that you should consider when opening a restaurant.

The 4 most common steps are:

- You must process your Municipal Operating License. You must request a Land Use and Feasibility Report of Type “C”, and specify that it is a restaurant that sells alcoholic beverages.

- If your application is approved, you will receive a Municipal Functioning Registration Plate. This still does not authorize you to sell alcohol in your restaurant.

- You must go to the offices of the Secretary of Government to request the License for the Sale of Alcoholic Beverages.

- When you have the authorization of the state government, you must request the increase from General Line to Alcohol Line at the Department of Operating Licenses.

For each of these steps, you will need different requirements such as:

- Constitutive Act.

- Your official identification or of the legal representative of the company.

- Federal Taxpayers Registry (RFC) of the partners of the company and the legal representative.

- Photographs from different angles of the facilities of your restaurant.

- Proof of address.

- Location sketch.

- Proof of payment.

- Power of attorney (with official identification of the attorney-in-fact)

- Copy of the Land Use Report.

The costs, difficulty of the procedures, and delivery times vary depending on where you are.

Municipal Outdoor Ad Permit

Despite being one of the least important on the list, the outdoor sign permit is vital for advertising your restaurant.

This is a municipal permit, so to know the exact requirements of your locality you should go to the municipal treasury offices.

Some of the most common requirements are:

- Fill in a form with the request for the ad and one for the technical opinion of the ad.

- Photograph of the place where you plan to place the ad.

- Company charter.

- A signed power of attorney authorizing the legal representative of the company to process this permit.

- Copy of the Business License.

- Current identification.

It is also a good idea to contact experts in the field for some advice on the type of ad you can place. This way you can avoid penalties due to the morality of the ad and more.

What Specific Permits Do You Need to Open a Food Truck in Mexico?

Opening a food truck in Mexico is one of the best low-cost alternatives that you can use to open a restaurant on wheels. Why? Simply because you will skip a large number of permits, save money, and time to start operating.

To open a food truck in Mexico you need about 3 permits and licenses, in addition to completing the necessary procedures to register your company. In addition, there is also the possibility of renting a food truck, which will greatly reduce costs in the beginning. Anyway, it is a good idea to create your personalized food truck, as it will give you more security in the long term.

These are the specific permits you will need to operate your food truck in Mexico.

Permit to Do Business in Public Spaces (Food Truck)

This permit is one of the most important that you must have in order before starting to operate your food truck. This is also a municipal permit, so you must go to the offices of your municipality to obtain all the requirements.

Some of the most common requirements are:

- A record of good sanitary practices that verifies that you prepare food in your food truck safely and hygienically.

- The approval of the local Civil Protection association.

- Photographs of the food truck from different angles and in color.

- Proof of address.

You will also need to make sure that you are operating in a non-prohibited line of business, such as selling alcohol — this is one of the downsides of food trucks.

One way to get advice to set up a food truck in Mexico is to join a food truck association since they will provide you with the necessary information for the permit.

Civil Protection Approval (Food Truck)

This is the same permit you would need for a restaurant. The main differences between what you need for a restaurant and a food truck are:

- Comply with the established and applicable rules of NOM-001-STPS, NOM-002-STPS, and NOM-017-STPS. It is not necessary, for example, that you have an emergency staircase.

- Have certified gas installations in good condition and correctly marked.

- Your employees (if you have one) must have training certificates issued by your local Civil Protection entity.

- And more depending on the regulations of your locality.

Normally food truck associations can help you with these procedures to speed up the start of your operations.

Other Aspects to Consider

Before starting to operate your restaurant or food truck, you should consider:

- Create a floor design for your restaurant or food truck that is efficient and safe.

- Decide whether to operate as a legal person or a natural person.

- Opening bank accounts for your business — which is vital to receive card payments.

- Get a legal representative for your company.

- Buy insurance for your restaurant or food truck.

- Join an association, such as your local chamber of commerce or food truck association, to get advice.

- And more.

Each of these decisions is important, so you should think carefully before making them.

Now You Know How to Open a Restaurant in Mexico!

There is no doubt that opening your own business is a great step in the professional improvement of any entrepreneur. However, making the right decisions at the start of your restaurant is vital to avoid potential setbacks and mistakes later on. That's why this guide will help you avoid a host of problems, such as fines for operating without permits, closures, and more. Remember to add the cost of these permits when creating the initial budget and business plan for your restaurant.

This way you avoid wasting more money and time while ensuring you run a successful business from day one!

Do you have your restaurant or food truck permits in order?