Restaurants have numerous costs that owners or managers must keep track of to keep them profitable and, ultimately, open and operating. Depending on the size of the restaurant, such costs can become complex enough to make the best manager's life a living nightmare. In this article, we'll talk about the following:

- The different restaurant costs and how to understand each

- Key metrics to track

- How to analyze cost data

- How to keep track of every penny with cost management tools

- Several strategies you can use to reduce costs and improve your restaurant's bottom line

No matter how simple or complex your business is, there's always room for improvement when it comes to profits and cost management efficiency. This article is the ultimate guide to help you improve your restaurant's bottom line by taking a deep look at its operating costs. Let's begin!

Types of Restaurant Costs

When you’re first taking a look at a restaurant’s costs, you’ll notice that there are several more items than meet the eye. Here’s a simplified list of all the main costs of a restaurant:

- Food and beverage costs: This is the most considerable expense for most restaurants, and it includes the cost of ingredients, produce, meat, seafood, dairy, and alcohol.

- Labor costs: This includes the cost of wages, salaries, and benefits for all employees, including cooks, servers, bartenders, and managers.

- Overhead costs: This includes the cost of rent, utilities, insurance, marketing, and other expenses that are not directly related to food or labor.

As a restaurant manager, you must keep track of all of these expenses, as well as your sales and profit margins to understand how your restaurant is doing economically. Also, understanding each of these costs is vital to optimize and lower them without affecting the quality of the service you provide – you must know where to lower costs. Finally, even though it’s a rather small list, you must also consider that all of these categories have numerous subcategories, which you must also know to understand the full picture. New owners or inexperienced managers often take a look at the prime costs, while leaving smaller ones to add up in the background and unnoticed until they have catastrophic consequences.

Key Metrics to Track

![]()

Even though we don’t discourage you from understanding and tracking each of the items above, there are a couple of metrics you must keep an eye on because they have the most impact on a food business. We’ve talked about food cost and how to calculate it in depth before so we won’t mention it here. The other ones you must keep track of are the following.

1. Prime Cost, Prime Cost Percentages, and How to Calculate Them

Prime cost refers to the two largest expenses in a restaurant, which are usually food costs and labor costs. These are the main costs in most food businesses and they usually amount to 50% to 60% of the restaurant's costs. This percentage is called the prime cost ratio and it's a method used to track restaurant costs when compared to profits. Here is the formula to calculate prime costs in a restaurant:

- Prime costs = food and beverage costs + labor costs

- Food and beverage costs (COGS): This includes the cost of ingredients, produce, meat, seafood, dairy, and alcohol.

- Labor costs: This includes the cost of wages, salaries, and benefits for all employees, including cooks, servers, bartenders, and managers.

Here is an example:

- Food and beverage costs: $100,000

- Labor costs: $50,000

- Prime costs: 100,000 + 50,000 = 150,000

Now, here's the formula to calculate the prime cost percentage:

- Prime cost percentage = ((food and beverage costs + labor costs) / total sales)*100

Here is an example:

- Prime costs: $150,000

- Total sales: $200,000

- Prime cost percentage: (150,000 / 200,000) * 100 = 75%

In this example, the restaurant's prime cost percentage is 75%. This means that for every $100 in sales, the restaurant spends $75 on food and labor. This is not a good number, and the prime cost percentage should be 60% or less. If the prime cost percentage is too high, it means that the restaurant is not making a profit and you must analyze food and labor costs to reduce it.

2. Labor Cost Percentage and How to Calculate It

There’s no doubt that labor is one of the biggest costs in a restaurant. A restaurant needs cooks, waiters, administrative staff, and many other members to work properly. A good staff is key to having a profitable restaurant because it wouldn’t produce anything without them. Taking a look at your restaurant's labor cost percentage and making changes toward efficiency without disrupting the quality of your staff is vital. Here are the steps you must follow to calculate labor in your restaurant:

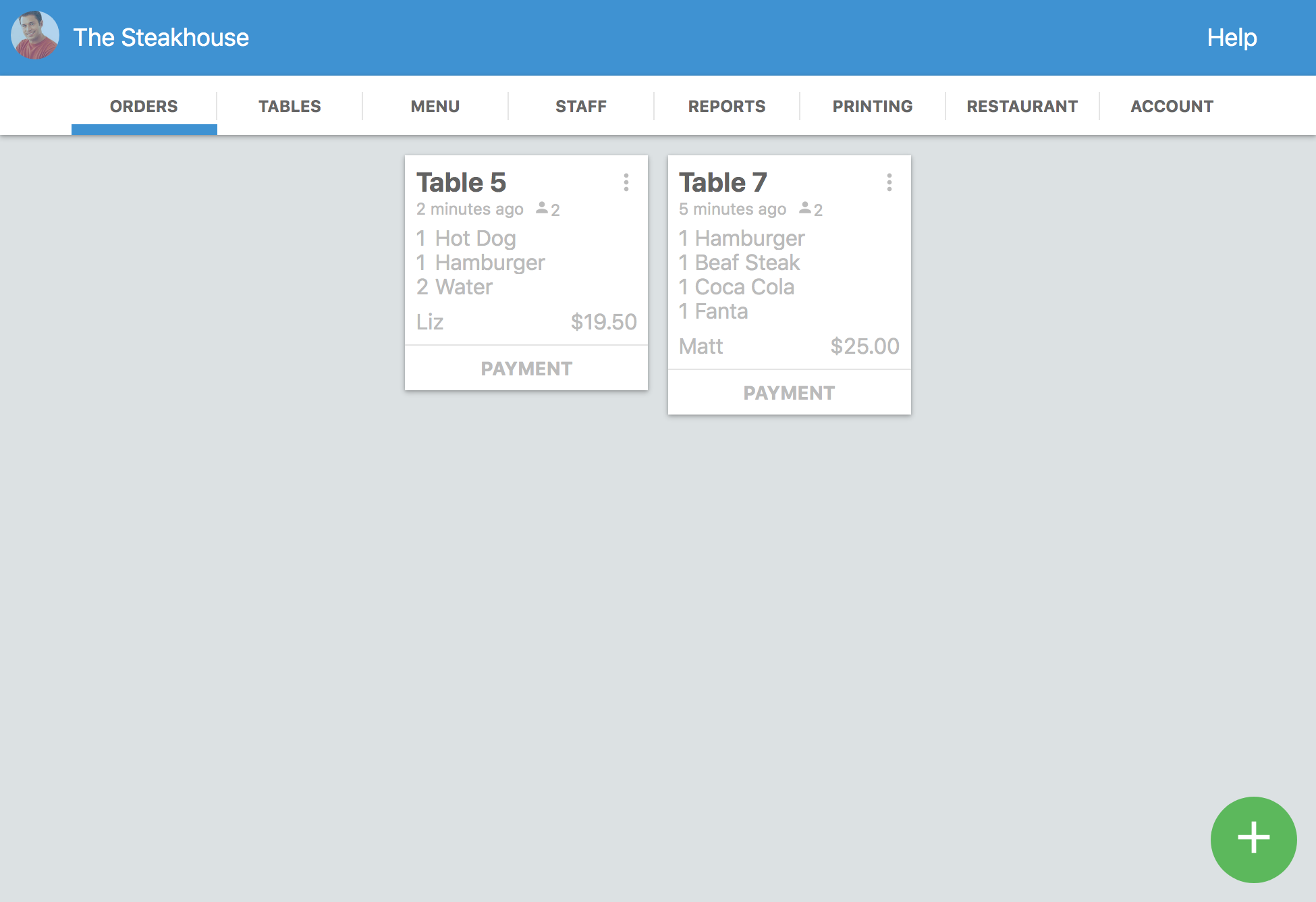

- Use your restaurant's POS system to obtain a detailed report of the month's sales and calculate the total amount.

- Gather all the information about each staff member's payment, extra hours, and other money you paid to your staff. Again, calculate the total amount.

- Calculate your labor cost percentage by dividing your total labor costs by your total sales and multiplying by 100.

Here’s a quick example:

- Total labor costs: $50,000

- Total sales: $100,000

- Labor cost percentage: (50,000 / 100,000) * 100 = 50%

Keep in mind that this is a very simplified example. If your restaurant spends 50% of sales on labor, it’s probably losing money because this calculation doesn’t take into account other heavy hitters in terms of cost, such as food or overhead costs.

How to Know if You Must Improve Your Restaurant’s Labor Costs?

This is something that must be analyzed on a case-by-case basis because how much labor costs affect your restaurant's bottom line depends on the rest of your costs. For example, if you spend 50% of your sales on labor, but the rest of your restaurant's expenses amount to 20%, the 30% left is still a viable profit percentage. Of course, this is not common in restaurants. Usually, a restaurant's labor cost is between 30% to 40%. To know if you must improve your restaurant's labor costs, you must take a look at how your restaurant is performing in terms of profit, how much are your labor costs relative to profits, sales, and other costs, and finally, if there is room for improvement in terms of efficiency. Here are a few tips depending on your restaurant's situation:

- If your restaurant has several waiters that don't do anything during busy times because they're not needed, then you can probably let them go and reduce your labor costs.

- If your restaurant is particularly inactive during specific days of the week, you can close it for the day or adjust your staff's schedule to reduce working hours.

- Automate specific tasks. For example, with Waiterio, you can reduce your waiting staff considerably. Customers can use their smartphones and scan a QR code on tables to send their orders directly from your online menu to the kitchen.

- Optimize your restaurant's kitchen and processes to reduce back-of-house staff.

Check out the following articles to learn more about how to optimize your staff:

- How to hire and maintain good front-of-house staff

- How to hire and maintain restaurant back-of-house staff

- A comprehensive guide to staff management

3. Profit Margins

Profit margins and sales vary a lot for restaurants depending on different factors, such as restaurant type, concept, cost trends, and labor costs, among others. As a manager or restaurant owner, you can’t expect profit margins to be stable regardless of your experience in the industry. Instead, you must have objective profit margins, which is a much more realistic management method. Restaurants might lose money or only cover operating costs for a month and increase net profit by a lot the next. Before calculating profit margins, let’s first understand the different types of profit stages you can calculate in a restaurant:

- Gross profit: This is the number resulting from subtracting the cost of goods sold (COGs) from the total sales of the restaurant.

- Operating profit: This is the number resulting from subtracting the total operating expenses of your restaurant from your gross profit.

- Net profit is the total left from subtracting the operating profit from taxes and interest expenses.

To simplify things, as a restaurant manager you must always be aware of your gross profit margin and your net profit margin. To calculate the gross profit margin, simply use the following formula:

- Gross profit margin: (COGs / total sales) * 100

Here’s an example:

- COGs = $50,000

- Total sales = $100,000

- Gross profit margin: (50,000 / 100,000) * 100 = 50%

Now, for the net profit margin, you must apply the following formula:

- Net profit margin = total sales - COGs - operating expenses - taxes

Here’s an example:

- Total sales = $100,000

- COGs = $50,000

- Operating expenses = $30,000

- Taxes (expressed as a number) = $10,000

- Net profit margin = 100,000 - 50,000 - 30,000 - 10,000 = $10,000

In this example, the resulting $10,000 are the 10% profit of the restaurant owner. Keep in mind this is expressed as a percentage – the total amount in currency can vary by a lot. Also, the 10% profit margin is not a rule, your restaurant can have a higher or lower profit margin. Ultimately, improving this margin depends on your satisfaction with the final number as an owner. All of the tips we’ve shared so far can help you improve your net profit margins. Also, check out our article about restaurant profit margins to expand on this information.

4. Other Important Metrics to Track

Other smaller, yet important metrics to keep track of are average check or bill, table turnover rates, customer satisfaction (which is a little more subjective), customer retention rates, and repeat business rates. These are slightly more difficult to keep track of mostly because you must pay attention to several details if you want to do it manually. Here’s how to calculate each of them. Keep in mind we’re not including customer satisfaction – check out our articles on how to improve it for more tips.

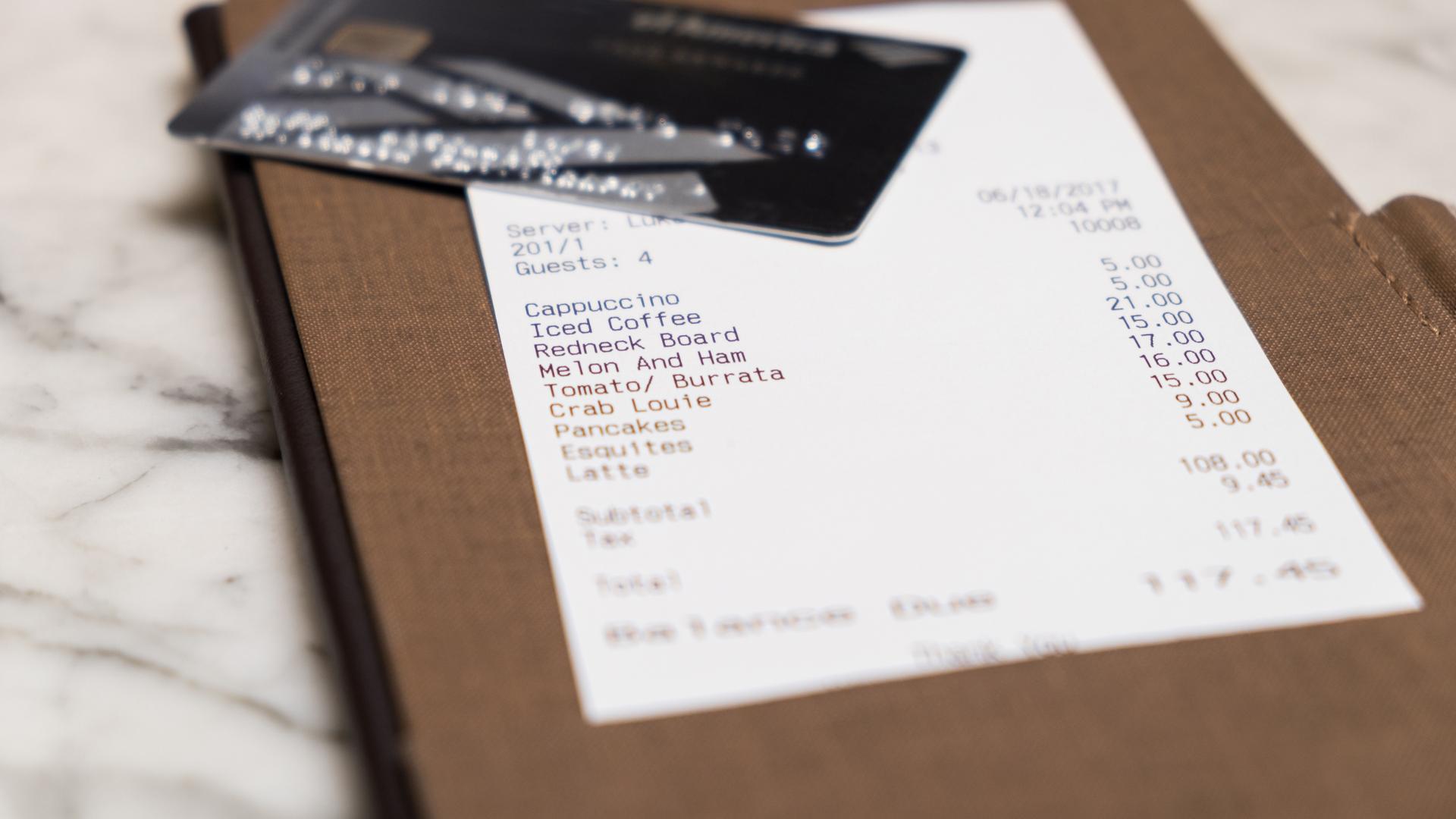

Average Check

The average check is the total amount of money spent by a customer on their meal, including food, drinks, and taxes. To calculate the average check, you need to add up the total sales for a specific period and divide it by the number of customers served during that period.

- Average check: If your restaurant had total sales of $10,000 in a month and served 1,000 customers, your average check would be $10.

Table Turnover Rate

The table turnover rate is the number of times a table is used to seat customers in a given period. To calculate the table turnover rate, you need to divide the total number of customers served by the total number of tables in your restaurant.

- If your restaurant has 100 tables and served 1,000 customers in a month, your table turnover rate would be 10 times per day.

Customer Retention Rate

The customer retention rate is the percentage of customers who return to your restaurant after their first visit. To calculate the customer retention rate, you need to divide the number of customers who return by the total number of customers who visited your restaurant in a specific period.

- Customer retention rate: If your restaurant had 100 customers in a month and 50 of those customers returned, your customer retention rate would be 50%.

Repeat Business Rate

The repeat business rate is the percentage of customers who visit your restaurant more than once. To calculate the repeat business rate, you need to divide the number of customers who visit your restaurant more than once by the total number of customers who visited your restaurant in a specific period.

- Repeat business rate: If your restaurant had 100 customers in a month and 30 of those customers visited your restaurant more than once, your repeat business rate would be 30%.

Analyzing Cost Data

Analyzing your restaurant’s costs, sales, and profit is vital to keep your restaurant running smoothly. It’s difficult to have a perfectly consistent management strategy in a restaurant – the food industry is incredibly complex and competitive. Instead, being informed of everything that happens in your business and being ready to respond accordingly to changes and trends should be your goal. How can you do this? Mostly, you have to do the following things:

- Analyze cost data regularly

- Try and identify fluctuating cost trends and areas for improvement

- And use data to make informed decisions about menu pricing, staffing, and other operational decisions

Below are some basic tips you can follow.

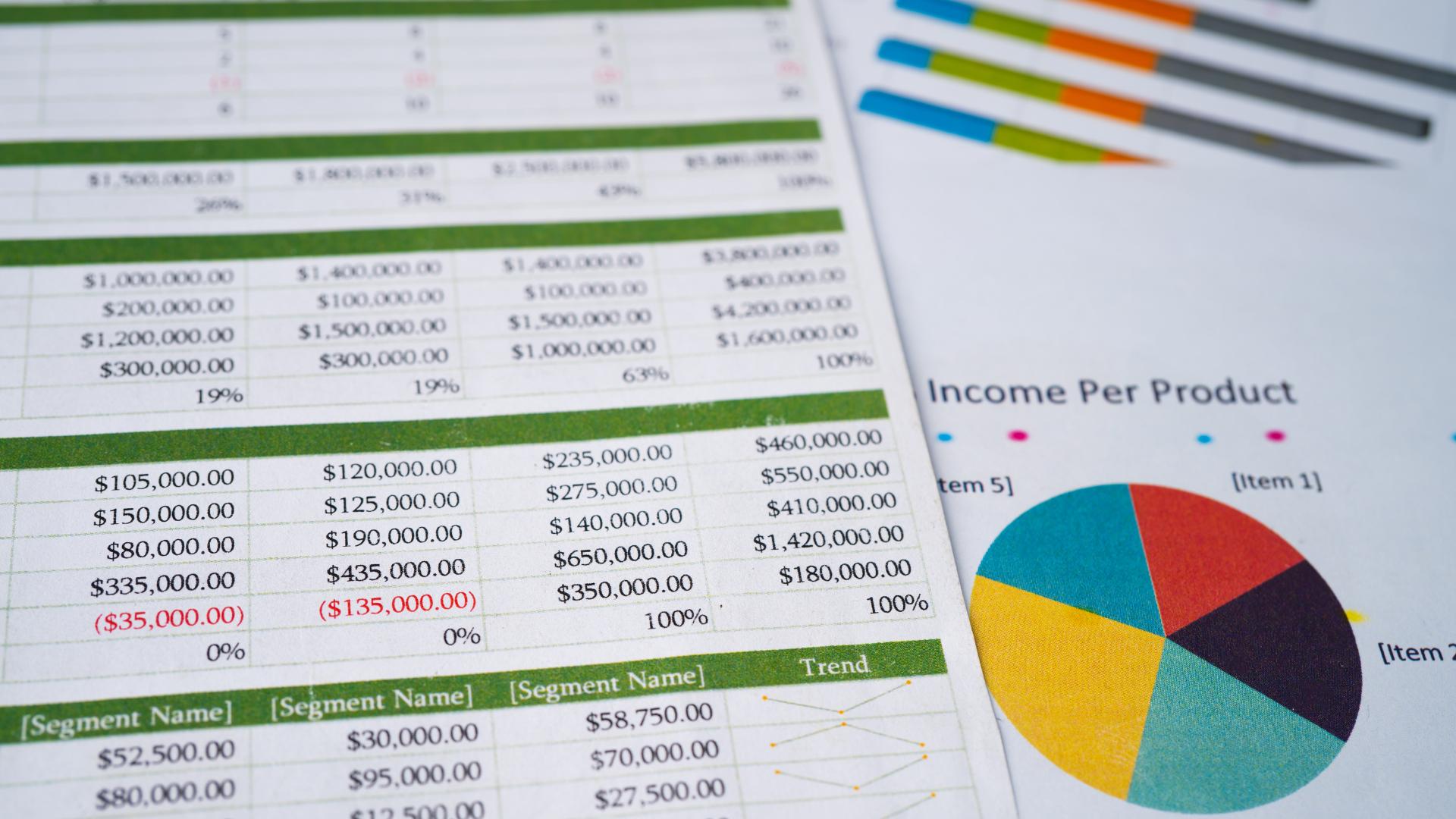

Keep a Spreadsheet With Every Cost Organized per Category

Even if you don’t have a lot of experience with accounting, having basic spreadsheet skills is vital for any manager interested in keeping up with restaurant costs. Sadly, it’s the easiest way of identifying issues that might be happening in the restaurant. It’s not technically difficult, just a little bit complex and intimidating if you’re not used to looking at spreadsheets with numerous items. Here are some recommendations to make this easier:

- Learn how to create graphs to visualize data easier

- Create a couple of template spreadsheets you can fill with every expense as soon as it comes up

- Keep a journal with every expense or debt of the restaurant and build the habit of filling the spreadsheet with it

This will make visualizing data and keeping track of expenses much easier, which will give you some predictability (just a little!) while managing the restaurant. It can also allow you to recognize issues such as theft or inventory management inefficiencies.

Create Plans Ahead of Time for Specific Situations

Managing a restaurant effectively requires effort and preparation, which is why planning and creating systems for specific situations is vital. This is especially useful when you’re trying to keep up with trends and adapt the restaurant to them effectively and on time. For example, you might notice that the restaurant’s sales are declining due to a specific issue or situation – like bad weather. If that’s the case, you can prepare the restaurant by reducing staff schedules, reducing supply orders, among other things. In some cases, it might be more sustainable to completely close the restaurant for a few days. Being prepared to act in those situations is key to having a profitable restaurant at all times – or at least to keeping it within your profit or budget objectives.

Strategies for Cost Reduction

On our blog, we’ve shared several articles that are highly relevant for cost reduction in your business. Check them out below:

- Cost-cutting for restaurants

- 5 tips to optimize profits

- Restaurant administration

- Suggestive sales in restaurants

- Getting the most out of your restaurant’s inventory

Tools for Cost Management

Even though there are numerous cost management tools available, we think only three are essential for anyone to manage a food business effectively:

- Restaurant management system: An app like Waiterio can give you highly detailed sales reports, which are necessary to make management decisions.

- Labor management system: They are very effective to optimize schedules, and staffing needs for specific days, among other things.

- Spreadsheet software such as Google Sheets or Excel: They are incredibly useful to visualize data and to use as a dashboard for management decisions. They are also compatible with restaurant POS systems – reports can be exported in this format to make the workflow much easier.

Considering they are vital to gather specific information about the restaurant’s economic performance, the most essential role is that of the manager. With an excellent manager at the head, a restaurant can do well even without some of these tools. Of course, they facilitate several processes, so using them can simplify the workload. Even though you can use many different applications to manage supplier relationships, and inventory management, among other common restaurant processes, it’s our experience that managing them manually is more effective to avoid issues. Of course, this is only viable in small to medium-sized restaurants – bigger restaurants and chain restaurants can benefit much more from other automation systems and software.

Attention To Detail is Key in Restaurant Management

A restaurant manager’s job can be very complex, but it can also be simplified with the right tools and practices. If you’re a new manager or restaurant owner, keep in mind that attention to detail can save your restaurant from wasting money. Even if a purchase or extra supplier payment seems small, it might leave your restaurant in red numbers because every penny adds up at the end of the month. Are you keeping a close eye on your restaurant’s economic performance? You better be!