Having a POS system is useful, and whenever you check the market for the top software for restaurants, you usually find Square POS among the top options. However, this top-notch option has a few downsides you should also consider when looking for the best POS system for your new or small food business. The biggest issue with Square is that it’s not affordable, which is one of the deciding factors for numerous entrepreneurs and small restaurant owners. In this article, we’ll talk about the following topics:

- Why Square is among the top POS system choices in the industry

- Its biggest drawbacks when compared to other solutions

- The top 6 Square POS alternatives for small food businesses

We’ll also take a brief look at the importance of POS systems in the restaurant industry. If you, like numerous other business representatives, have decided that Square POS is not the best fit for your business, you’ll find the perfect alternative solutions in this article. Let’s get started!

The Importance of Having a Modern Restaurant POS System

A modern POS system isn't just a fancy cash register; it's a vital tool that streamlines operations, boosts efficiency, and unlocks valuable data. A modern restaurant POS takes care of numerous management functions, which can facilitate the job of a manager or owner. Restaurant owners nowadays are better equipped to start managing their restaurants with modern POS tools. They don’t require business consultants or a manager to be competent at managing their businesses. Plus, modern restaurant point-of-sale solutions have dozens of features and integrations that facilitate different processes in the restaurant. From administration to staff management, the workflow is more manageable when using a solution that fits your business’s needs.

The Customer Satisfaction Perspective

All of that is only from the perspective of restaurant management. Still, there are also positive aspects directly related to customers and their satisfaction. From taking orders and managing inventory to tracking profits and building customer loyalty, a sound POS system empowers you to deliver experiences that keep customers coming back. For example, restaurant POS solutions can be compatible with different payment methods, which is vital for convenience. Convenience is a defining factor in attracting and maintaining customers across different service and direct-to-consumer industries, especially in restaurants and other business types in the hospitality industry. This has evolved along with the industry to create different versions of food businesses, like ghost kitchens, delivery-and-takeout-only food businesses, food trucks, and more. That, in turn, has changed the needs of food businesses when it comes to POS systems. To summarize, modern restaurant POS systems have crucial roles in the ecosystem of the restaurant industry.

Why Is Square One of the Top Restaurant POS Solutions?

Square is one of the top restaurant POS solutions because it solves numerous issues by giving you as many tools as you need and want. Square figured out convenience is the name of the game early on. That fueled its growth across different industries and niches as the top POS solution. It’s hard for other companies to compete with software that has most, if not all, of the tools. Here are some of the key features of Square POS:

- Point-of-sale terminal: Take orders quickly and accurately with table management and split bill capabilities.

- Kitchen Display System (KDS): Send orders directly to the kitchen for seamless preparation and improved efficiency.

- Online Ordering: Expand your reach and offer convenient ordering options with integrated online ordering and delivery platforms.

- Real-time inventory tracking: Monitor stock levels, prevent spoilage, and optimize purchasing with accurate inventory reports.

- Menu builder and customization: Create and customize menus, set pricing, and manage ingredients easily.

- Customer profiles and history: Track customer preferences and order history for personalized service and targeted marketing.

- Sales reports: Gain valuable insights into sales performance, identify trends, and analyze profitability across different channels.

- Employee management: Track employee time, manage payroll, and assign tasks efficiently.

- Integrations: Connect with a wide range of third-party apps for accounting, marketing, delivery services, and more.

- Hardware options: Choose from various proprietary hardware options like tablets, mobile POS systems, and countertop terminals.

All of those tools and more make Square one of the most versatile POS systems for restaurants out there—but all that comes with steep costs.

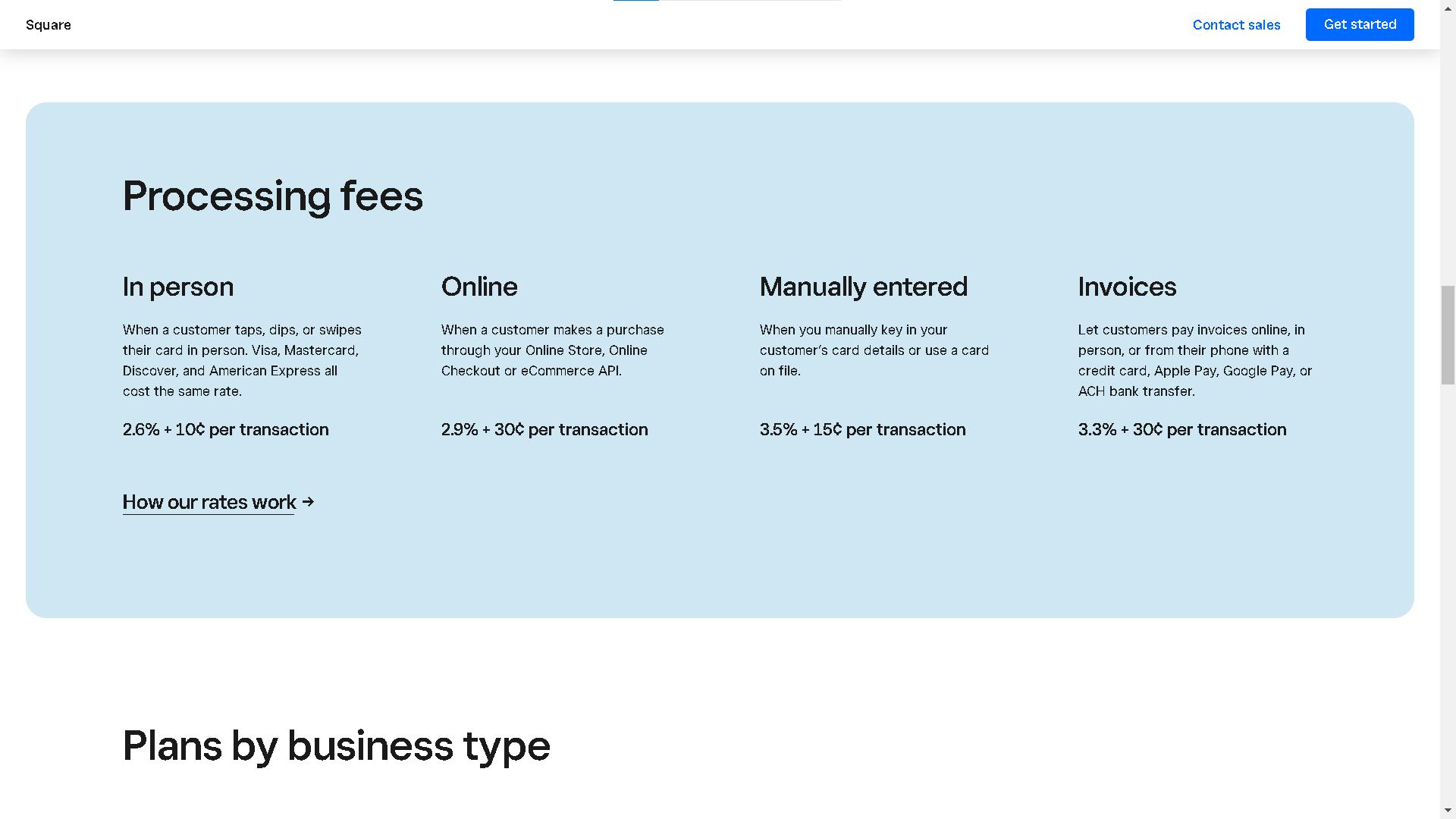

The Major Drawback of Square POS

The only issue that seems to send potential Square POS customers running away is its cost. This is mostly because, even though the company has a free plan, it still charges you for using its proprietary card readers and for other features. Here’s a breakdown of their current credit card fees:

- In-person: When a customer taps, dips, or swipes their card in person. Visa, Mastercard, Discover, and American Express all cost the same rate. The cost is 2.6% plus 10¢ per transaction.

- Online: When a customer purchases through your online store, checkout, or e-commerce API. The cost is 2.9% plus 30¢ per transaction.

- Manually entered: When you manually key in your customer’s card details or use a card on file. The cost is 3.5% plus 15¢ per transaction.

- Invoices: Let customers pay invoices online, in person, or from their phone with a credit card, Apple Pay, Google Pay, or ACH bank transfer. The cost is 3.3% plus 30¢ per transaction.

Don’t get us wrong, you can get excellent deals from the company if you get a direct quote and try to renegotiate these hefty credit card fees. Still, that’s an option that’s only viable for businesses with a large cash flow.

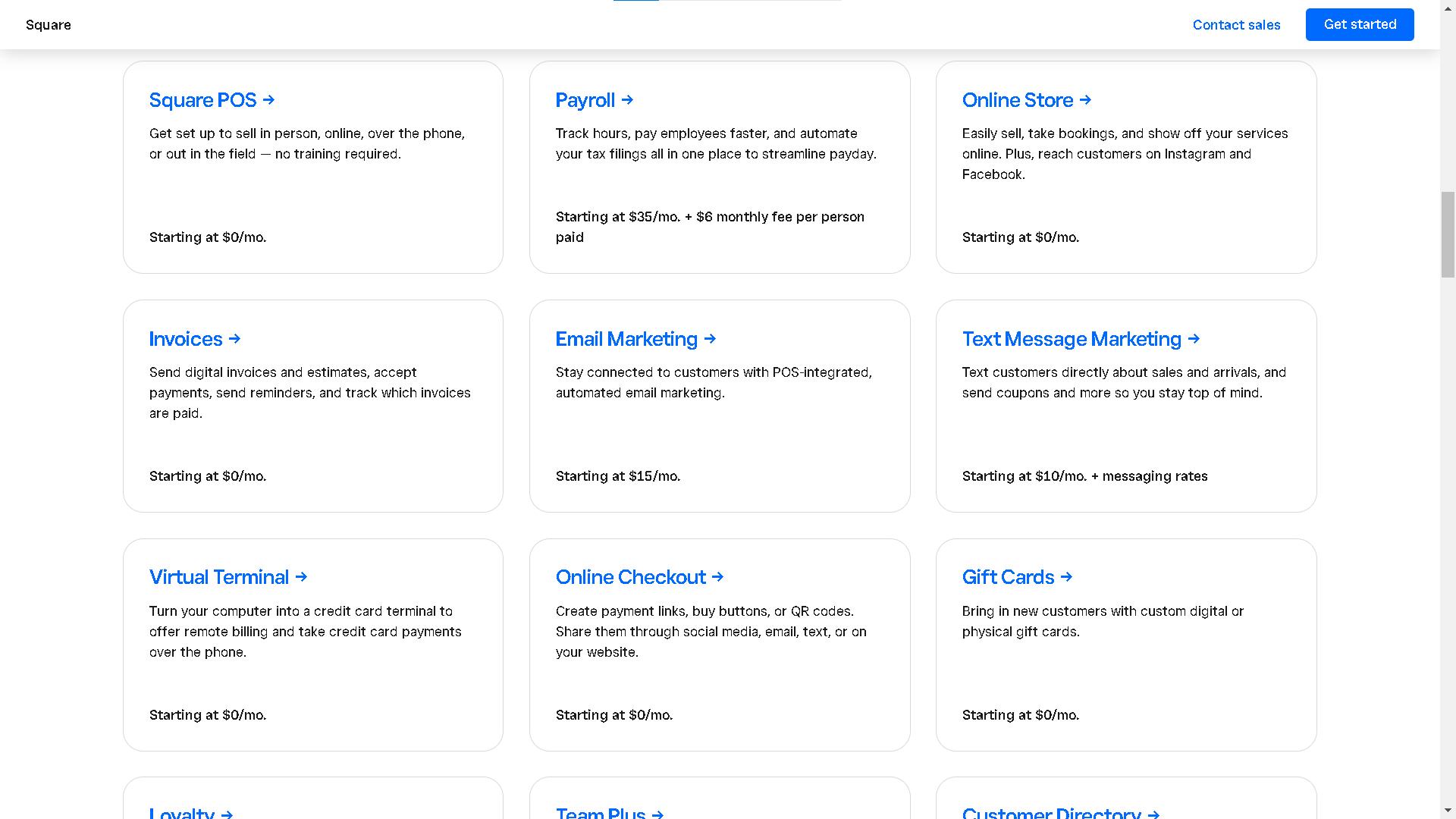

Cost of Extra Features

Beyond the base "free" plan, Square offers several features that require additional fees or paid subscriptions, like the $60/mo. for the Plus plan or the custom pricing offered to premium users. So, not everything is free. Below are the costs of other features you might want to add to the POS system:

- Additional POS Devices: While one countertop POS device is included in the Plus plan, additional devices like mobile POS or kitchen display systems incur monthly fees.

- Hardware Accessories: Cash drawers, receipt printers, barcode scanners, etc., are purchased separately. The cheapest hardware accessory on Square right now is their Square Terminal, priced at $299. We’re not including the $149 iPad stand because if you don’t have an iPad, the full cost is well over $500.

- Seat Management: Available in the Plus plan and higher.

- Online Ordering and Delivery: This allows customers to order and pay online and integrates with delivery services. Available in the Plus plan and higher.

- KDS (Kitchen Display System): displays orders directly in the kitchen for improved efficiency. It’s available for the free plan at $20/mo. per device.

- Employee Management: Track time, permissions, and payroll. Some of the features are free and unlimited in the Premium plan and higher, but most cost monthly fees for free plan users.

- Integrations: Connect with third-party apps for accounting, marketing, CRM, etc. Many integrations require separate subscriptions.

- Several add-ons unlock additional features like team permissions, advanced reporting, team management, shift management, loyalty and marketing, payroll, and invoice services.

You don’t have to pay for all of them. But those prices are why this POS system is among the most expensive solutions for small restaurants, especially when considering the excellent, affordable Square POS alternatives available to you.

Top 6 Affordable Square POS Alternatives

When you open a small, new restaurant, keeping your costs low is a vital part of helping the business become profitable quickly. Affordable alternatives for Square POS are your best bet for lowering the cost of every transaction. Regardless of how good the services Square provides are, more affordable alternatives can really make a difference in your bottom line. Below, we list the top most affordable alternatives to Square that you can implement in your restaurant from day one.

1. Waiterio Restaurant POS:

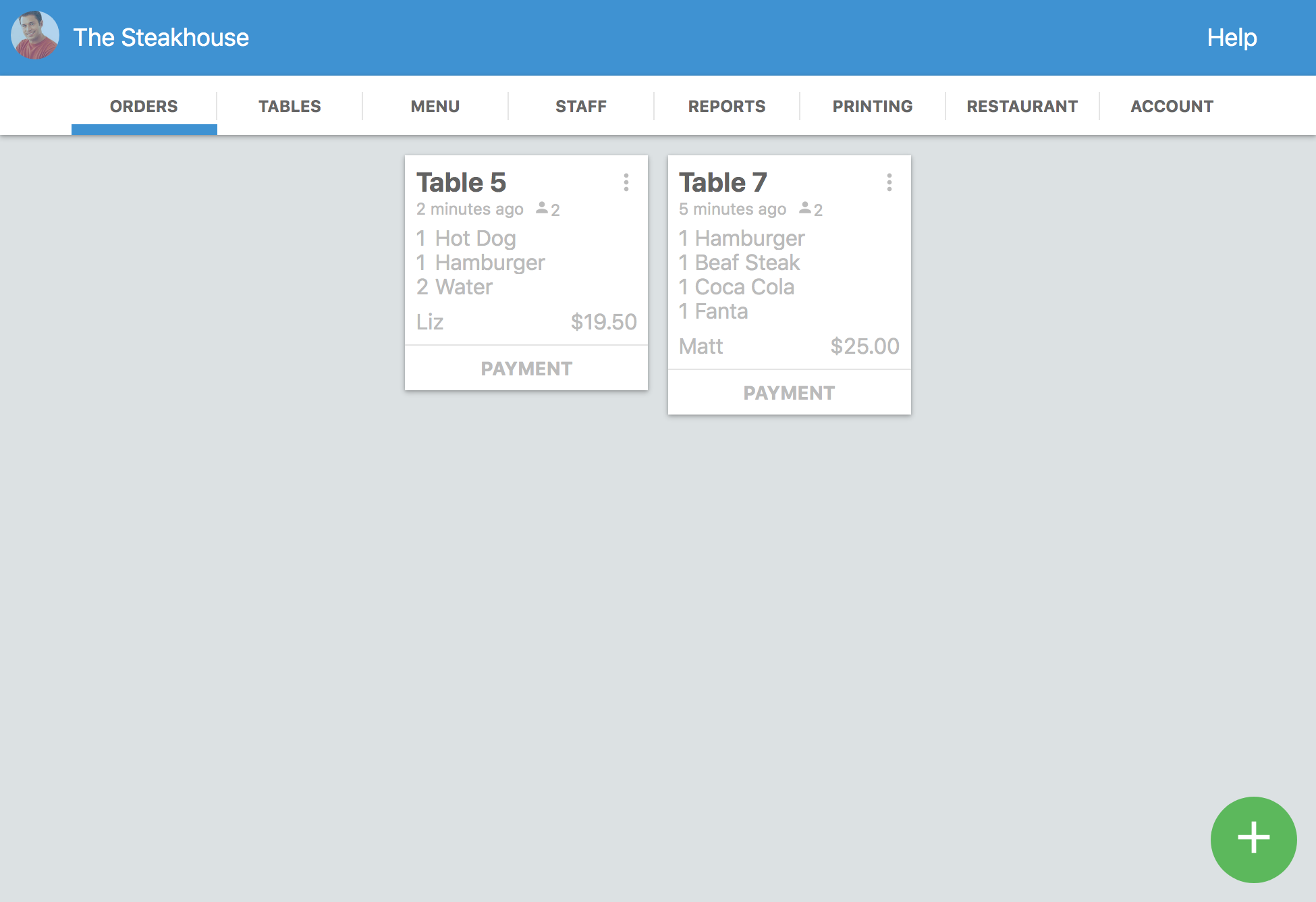

Waiterio is a simple, effective, and, most importantly, affordable POS system you can use in your restaurant. In comparison to Square, Waiterio is much more affordable, which is beneficial for a new restaurant. Here’s the cost breakdown between the two solutions:

- Square POS, on average, charges 2.95% plus 22 cents per transaction.

- Waiterio POS charges a monthly subscription of $60 and doesn’t charge transaction fees of any kind. You can add them to your business by using third-party card readers, so you can get the lowest rates you can without harming compatibility with our software in any way.

So, for this example, we’ll calculate how much each POS costs for a restaurant that generates $100.000. We’ll compare Waiterio’s yearly cost to Square’s monthly cost.

- Square POS:

- Transaction fee: 2.95% + 22 cents = 3.17 cents per dollar.

- Annual cost for $100,000 in sales: $100,000 * 3.17% = $3170.

- Waiterio POS:

- Monthly subscription: $60.

- Annual cost: $60/month * 12 months = $720.

As you can see, the Waiterio yearly cost is a fourth (actually, 4.4) of the monthly cost of Square POS. Of course, that doesn’t include the cost of other Square services and hardware—adding that would make the solution almost impossible to use affordably for a new restaurant. On the other hand, Waiterio is much more convenient in that sense as well.

- You can use numerous affordable third-party hardware solutions with Waiterio.

- It’s also compatible with different devices and operating systems. You can pick the one that works best for your business, including the best-value-for-your-money hardware.

- The compatible hardware options include KDS, receipt printers, card readers, and mobile and desktop devices from different brands.

- And the best part is that Waiterio has all the features you need for your restaurant at no additional cost.

You can also use it for free—learn more about Waiterio here.

2. TouchBistro:

TouchBistro is another high-end POS system for iOS and Apple devices, and it’s one of the main competitors of Square POS. The good thing about TouchBistro is that it offers a much more affordable basic plan and slightly better transaction fees. Let’s compare TouchBistro’s and Square’s POS's monthly subscriptions and transaction fees. Here’s what the cost breakdown looks like for a restaurant that produced $100,000 in one month:

- Square POS:

- Transaction fees: $100,000 x (2.95% + $0.22) = $3,170.00

- Total cost: $3,170.00 (transaction fees) + additional costs for hardware and features (optional)

- TouchBistro:

- Monthly fee: $69

- Transaction fees: $100,000 x (2.25% + $0.15) = $2,475.00

- Total cost: $2,544.00

Based solely on those features, TouchBistro comes on top due to its better overall features available in the basic plan and its lower transaction fees. Why is it cheaper? Because many of the features available in TouchBistro’s basic plan are available as separate, paid solutions in Square POS. Keep in mind, though, that both solutions work only for iOS and Apple devices, so hardware costs will be similar.

3. Loyverse:

Loyverse is an interesting solution because it offers numerous personalized payment options. Here's the cost roundup for Loyverse services:

- A free basic POS, a dashboard for analytics, KDS, and a customer display system.

- It offers a monthly payment for employee management at $5 per employee.

- It offers advanced inventory solutions for $25 per month.

- It offers integrations at $9 per month plus possible third-party service fees.

Aside from that, the company doesn’t offer card readers or similar services. Instead, they offer compatibility with some of the best payment processing companies available across the world. For example, in the US, they offer Zettle, Worldpay, and SumUp, all of which are very affordable. SumUp has card-processing fees of 1.69% per transaction for in-person transactions and 2.5% for keyed-in and online purchases. On average, these fees are already lower than Square’s.

Here's what a cost breakdown would look like for a restaurant that produces $100,000 per month:

- Base Cost:

- Loyverse POS, Dashboard, KDS, and Customer Display System are free.

- Additional Cost Examples:

- Employee Management: Assuming 5 employees, the cost would be 5 employees * $5/employee = $25 per month.

- Advanced Inventory: This may or may not be needed depending on the restaurant's inventory complexity. If needed, it would cost $25 per month.

- Integrations: This can vary depending on the needed integrations and third-party fees. Let's assume one integration with a monthly fee of $10 and no additional third-party fees. This would be $9 (Loyverse) + $10 (integration) = $19 monthly.

- Card Processing Fees: Assuming all $100,000 in sales are in-person transactions, the card processing fees would be 1.69% * $100,000 = $1,690 per month.

- Total monthly cost:

- Base Cost + Additional Costs = $0 + $25 + $19 + $1,690 = $1,734 per month.

TouchBistro’s monthly cost would be $1,734 per month, which is much lower than Square’s $3,170 monthly transaction fees—and, again, that’s without including Square’s paid extra features.

4. E-POS Now:

E-POS Now is another competent solution that offers interesting customization options—it’s comparable to Loyverse in that sense. The base cost for the “complete solution” POS for restaurants is a monthly subscription of $99. They also offer undisclosed card processing solutions that, according to our research, charge around 2.6% + $0.10 per transaction. Here’s what the cost breakdown looks like:

- Base costs:

- Monthly Subscription: $99

- Transaction Fees: $100,000 * 2.6% = $2,600

- Per-Transaction Fee: $100,000 * $0.10 = $1,000

- Total monthly cost:

- $99 (subscription) + $2,600 (transaction fee) + $1,000 (per-transaction fee) = $3,699 per month

It’s a bit pricier than Loyverse, and the latter seems to be the overall better solution when comparing them because it offers some features at no additional cost. However, when compared to Square’s POS, E-POS Now has the advantage that its POS solution is more complete, so the latter’s pricing structure makes much more sense for a small business.

5. Toast POS:

Toast is yet another interesting solution because it offers two starter plans specifically designed for new or small restaurants. They’re called the “pay-as-you-go” plan and the standard plan. Depending on your budget, you can take advantage of any of the two options to gain an effective POS solution that’s very convenient if you’re barely making a profit. Here’s a breakdown of what it would cost you to invest in either of them:

- Pay-as-you-go:

- Transaction Fees: $100,000 x (2.99% + $0.15) = $3,185 per month

- Hardware: Included, covers all costs except shipping and taxes.

- Software: Included with the pay-as-you-go single rate.

- Total Monthly Cost: $3,185 (transaction fees) + $0 (hardware) + $0 (software) = $3,185 per month

- Standard:

- Upfront Hardware Cost: $875

- Transaction Fees: $100,000 x (2.49% + $0.15) = $2,685 per month

- Monthly Software Fee: $69 per month

- Total Monthly Cost: $2,685 (transaction fees) + $69 (software) + $0 (hardware) = $2,754 per month

As you can see, the standard plan doesn't cover the monthly fee of $69 per month; however, fees are lower. If you don’t have enough to buy the hardware upfront, then the better option is the pay-as-you-go plan, but keep in mind that you’ll spend more on transaction fees. Regardless of which one you choose, they are both more viable than Square’s free plan because you don’t have to pay anything out of pocket.

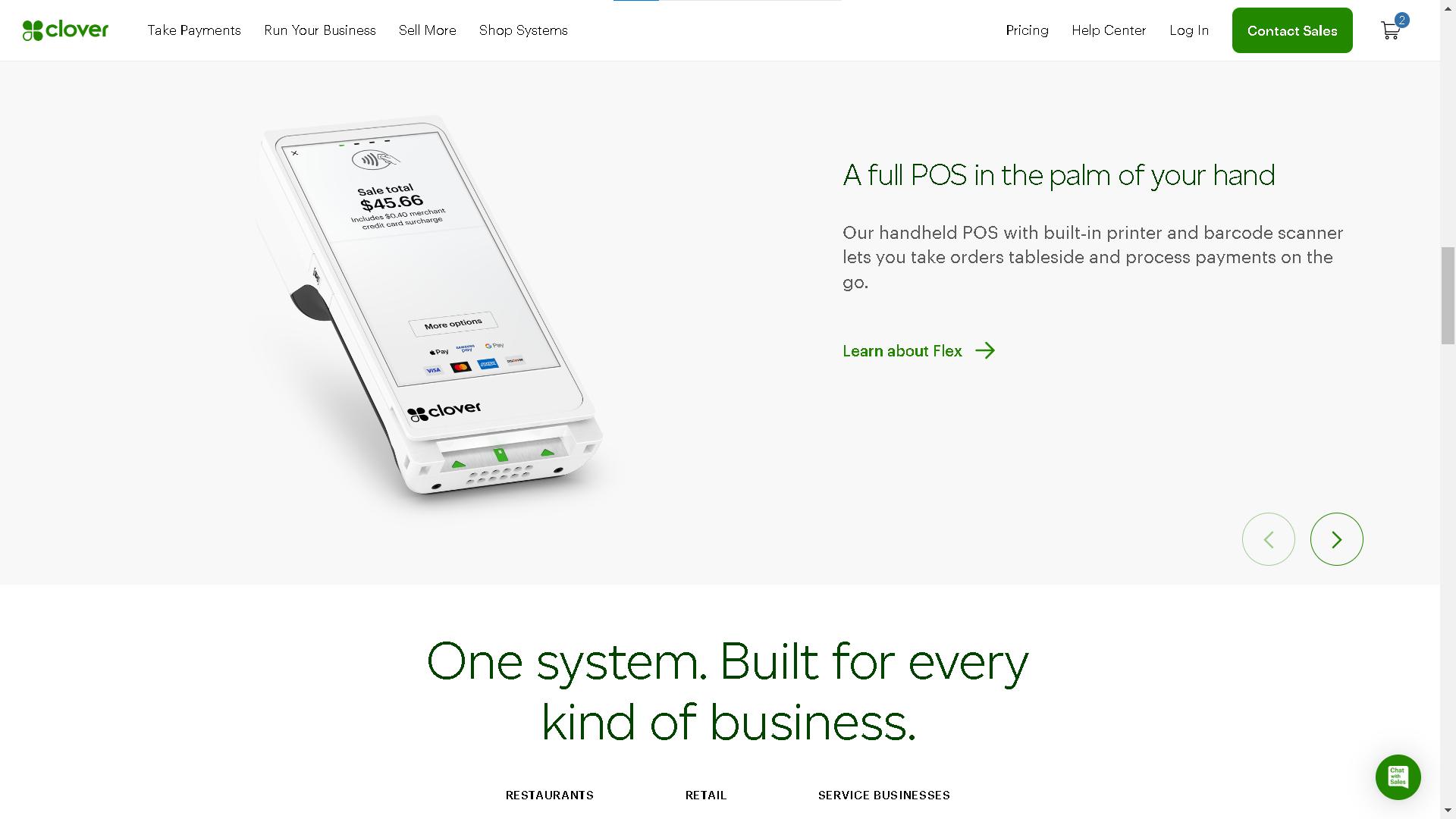

6. Clover POS:

Clover is a nice cherry on top for this comparison article. It’s an efficient point-of-sale system that offers some of the most affordable customization options. Their essentials plan costs only $14 per month, which is inexpensive and includes most of the features a small restaurant needs. Their proprietary hardware, such as mobile card readers, is among the cheapest on the market as well. Still, you’re not safe from processing fees. Here’s an example cost breakdown like the ones before:

- Cost Breakdown:

- Transaction Fees: $100,000 * (2.6% + $0.10) = $2,700 per month

- Basic Plan Subscription: $14.95 per month

- Total Monthly Cost: $2,700 (transaction fees) + $14.95 (subscription) = $2,714.95 per month

Clover’s portable card reader and Go Dock charger cost $78, including shipping (but not taxes). Even after adding that, the restaurant is still getting an effective POS solution and the necessary hardware to operate the business at a reasonable price of $2,792.95 for the first month. That then drops to $2,714.95 monthly (if the restaurant keeps generating the same amount). Compared to the other solutions, this one offers very competitive prices. However, other plans have more features you might need, so the final prices might vary. Still, they offer very competitive card processing fees.

The Right POS System Empowers Your Restaurant

If you’re looking for the best restaurant POS with affordable prices and the lowest card processing costs, Waiterio is the solution your business needs. Our POS system allows you to bypass all of the extra charges of the companies listed here. That way, you can find better card processing fees that are available to you locally, making our system globally competitive—and that’s without mentioning its in-built translation tool. Regardless of which system you choose, it’s vital to choose one that adapts to your restaurant’s needs, including early profitability goals. Is your POS system affordable enough?